Content

Limited liability companies , limited partnerships, limited liability partnerships and corporations are the most common forms… There are different individual costs for each component of your service or product. Be sure to analyze every component of the product or service’s total cost. Accounting For Day Care Business � Child Care � Homewood, Il Cpa Firm Upon completion of the analysis, prices can be established to maximize profits and eliminate deficit services. Material, labor and overhead costs are included in the cost components. You will need to identify your objectives and organize the collection/analysis process first.

Cash and accounts payable are lessened with an inventory payment is made. The collection of receivables will raise your cash. At this point, the operating cycle and the cash has made a full circle and will start again. You may be required to obtain a business bank account, a separate business telephone, a work certificate or license from the state, and a sales tax number for registration and accounting standards.

Job Seeker Tools

Because temporary work site living expenses are separate from home travel expenses, they may be deducted. Deduction limits are obligatory for your boss, not you, and the floor of 2% of AGI on miscellaneous itemized deductions will not have an effect on your travel and meal costs. Normally, you can only deduct the cost of a meal when away on a business-related trip or gone overnight.

You can either keep cash on hand or in a business bank account in order to take care of the expenses. This will be enough to allow the company to pay bills, to supply investment capital and to have sufficient funds in case of emergencies. Education expenses (seminars, books, consulting fees, etc.).

Staff Accountants

There is no double taxation as with “C” corporations because income tax is not taxed at the corporate level. Also known as Subchapter “S” corporations, they are limited to 100 shareholders. Several word processing programs produce typed documents and provide text-editing functions, while desktop publishing programs allow you to create good quality print materials on your computer.

- After the list is compiled, spend time with each of them and slowly eliminate attorneys.

- It is necessary to keep good records to prepare current financial statements like income statements and cash flow projections.

- An indemnity plan or insurance permits each employee to decide their own doctor.

- The Staff Accountant will report directly to the Controller and will work proactively and independently in a fast-paced office environment.

- Emily began her career in auditing with Arthur Andersen, then moved into management roles in the private sector.

These defer from worker’s compensation as they pay benefits for non-work related illness and injury, and can be either short-term or long-term. With coinsurance, a percentage of the medical expenses are paid by the employee and the remaining are covered by the plan. 20 percent is the normal coinsurance amount to be paid by the employee – the remaining 80 percent is paid by the plan.

Jackson Hewitt Tax Service

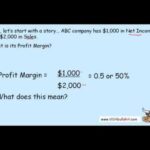

A “corporate double tax” happens when a business corporation pays a federal tax on its income, and then its owners pay another tax as they collect corporate profits. The “entity level tax” is the tax on the corporation and so an entity taxed in this way is called a “C corporation” or C corp. Labor costs are calculated based on the total work put into preparing the product.

- There may be policies for entering and exiting the workforce of the business.

- She then joined a real estate development company as their Controller.

- When the workday concludes, Michelle enjoys cooking, spending time with her family, and taking cruise adventures.

- A state normally treats the entity selected under federal check-the-box as the entity acknowledged for state tax purposes, but this is not always the case.

- The employee has the choice from several levels of supplemental coverage or different benefits packages.

It is important to have sufficient cash on hand to pay for expenses and emergencies. Cash beyond this should be put in a manageable, low-risk, interest bearing account, like a savings account, Treasury bill or short-term certificate of deposit. One of the main reasons small businesses collapse is they have a poor cash flow strategy… The purpose of the family strategy is to keep a well-functioning business.

Save Your Search with Free Email Alerts

This insurance also comes into play to protect your personal assets in the event that the court ignores your limited liability status. A major concern is the limitation of liability, especially malpractice liability. https://quick-bookkeeping.net/how-much-are-taxes-for-a-small-business/ Against the liability of your own malpractice, there is no entity that will protect you. Depending on the state law, Professionals Corporations might not offer protection from liability for a co-owner’s malpractice.

- Because temporary work site living expenses are separate from home travel expenses…

- Must be highly motivated and able to work independently and in a team environment.

- Mediation consists of a third party who helps the two parties talk about the problems and hopefully reach an agreement.

- This insurance can also protect your corporate assets from claims and lawsuits, as well as protect your personal assets in certain situations.

- Long-term disability commences after the conclusion of the short-term benefits.

- Failure to have shareholder or director meetings can cause the corporation to be subject to alter ego liability…

If your phone is broken, search for a local cell phone repair shop in our directory. Insure your business and your personal possessions with a solid policy. Research the different addiction counseling services, including drug and alcohol dependency treatments in your area. Advantage Nursing Services, Inc. is seeking RNs and LPNs for pediatric home care in Chicago Heights, Wednesdays and Thursdays 2 to 11 p.m.

The Best 10 Accountants near Country Club Hills, IL

Compare local private elementary and high school programs. Listings of local plumbing and HVAC training programs. Compare the mental health counselors for adolescents. Our systems have detected unusual traffic activity from your network.